SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Robert A. Imparato, Jr CFP®

CERTIFIED FINANCIAL PLANNER™ professional

Craig A. Hyldahl CFP®

CERTIFIED FINANCIAL PLANNER™ professional

R.I.C.H. Planning Group, LLC

105 Fieldcrest Avenue, Suite #507

Edison, NJ 08837

Robert: 732-326-5240

Craig: 732-326-5240

Fax: 732-326-5331

Robert: robert@richplanninggroup.com

Craig: craig@richplanninggroup.com

Website: www.richplanninggroup.com

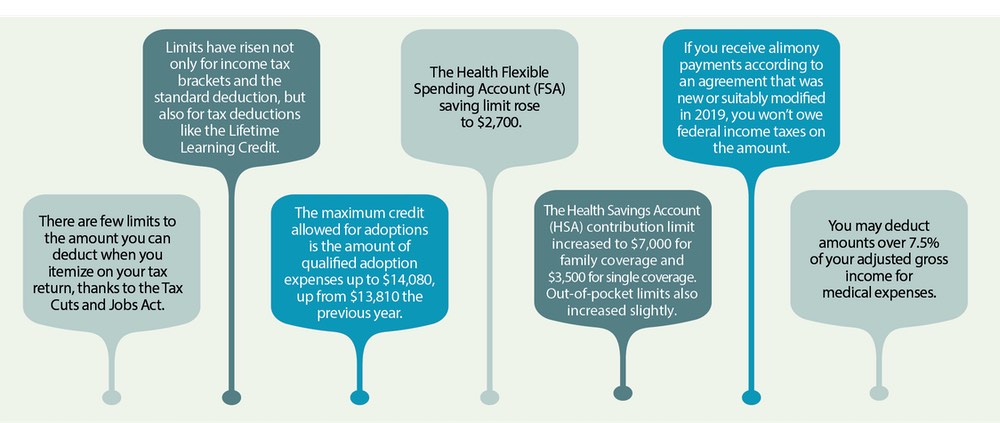

If you haven't filed your 2019 federal tax return yet, the Internal Revenue Service offers some reminders that may help reduce your income taxes for the year, but don’t forget to consult a tax advisor about your individual tax picture, too. Here is a sampling of tax breaks that may help you reduce your 2019 tax bill.

GE-2763334(10/19)(exp.10/21)

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Securities offered through Equitable Advisors, LLC (NY,NY (212) 314-4600), member FINRA,SIPC (Equitable Financial Advisors in MI & TN). Investment advisory products and services offered through Equitable Advisors, LLC, an SEC-registered investment advisor. Annuity and insurance products offered through Equitable Network, LLC, which conducts business in California as Equitable Network Insurance Agency of California, LLC; in Utah as Equitable Network Insurance Agency of Utah, LLC; and in PR as Equitable Network of Puerto Rico, Inc. Equitable Advisors and Equitable Network are affiliated companies and do not provide tax or legal advice.

R.I.C.H. Planning Group, LLC is not owned or operated by Equitable Advisors or Equitable Network. Equitable Advisors and Equitable Network are brand names for Equitable Advisors, LLC and Equitable Network, LLC, respectively.

GE-4833845.1 (7/22)(Exp. 7/24)

CFP® and CERTIFIED FINANCIAL PLANNER™ are certification marks owned by the Certified Financial Planner Board of Standards, Inc.

These marks are awarded to individuals who successfully complete the CFP Board's initial and ongoing certification requirements.

R.I.C.H. Planning Group, LLC and LTM Marketing Specialists LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Client Marketing, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.